New Ct Tax Laws 2024. The state’s bottle deposit will increase from 5 cents to 10 cents for many containers and a “clean slate” law will automatically erase the criminal records of people with certain convictions. The governor said connecticut’s new earned income tax credit is increasing from 30.5% to 40% of the federal eitc and this will provide an additional $44.6 million in state tax credits to.

An estimated 1 million tax filers in connecticut — representing 59 percent of all filers — can expect some level of relief in the new year under what gov. New laws going into effect january 1, 2024.

Lamont said that in total, the three measures will reduce taxes for connecticut taxpayers by approximately $460.3 million.

Ct Tax Rates 2024 Dorie Geralda, New laws go into effect a few times a year in connecticut and that includes jan. Joint filers will pay $600 less, and single filers will pay $300 less.

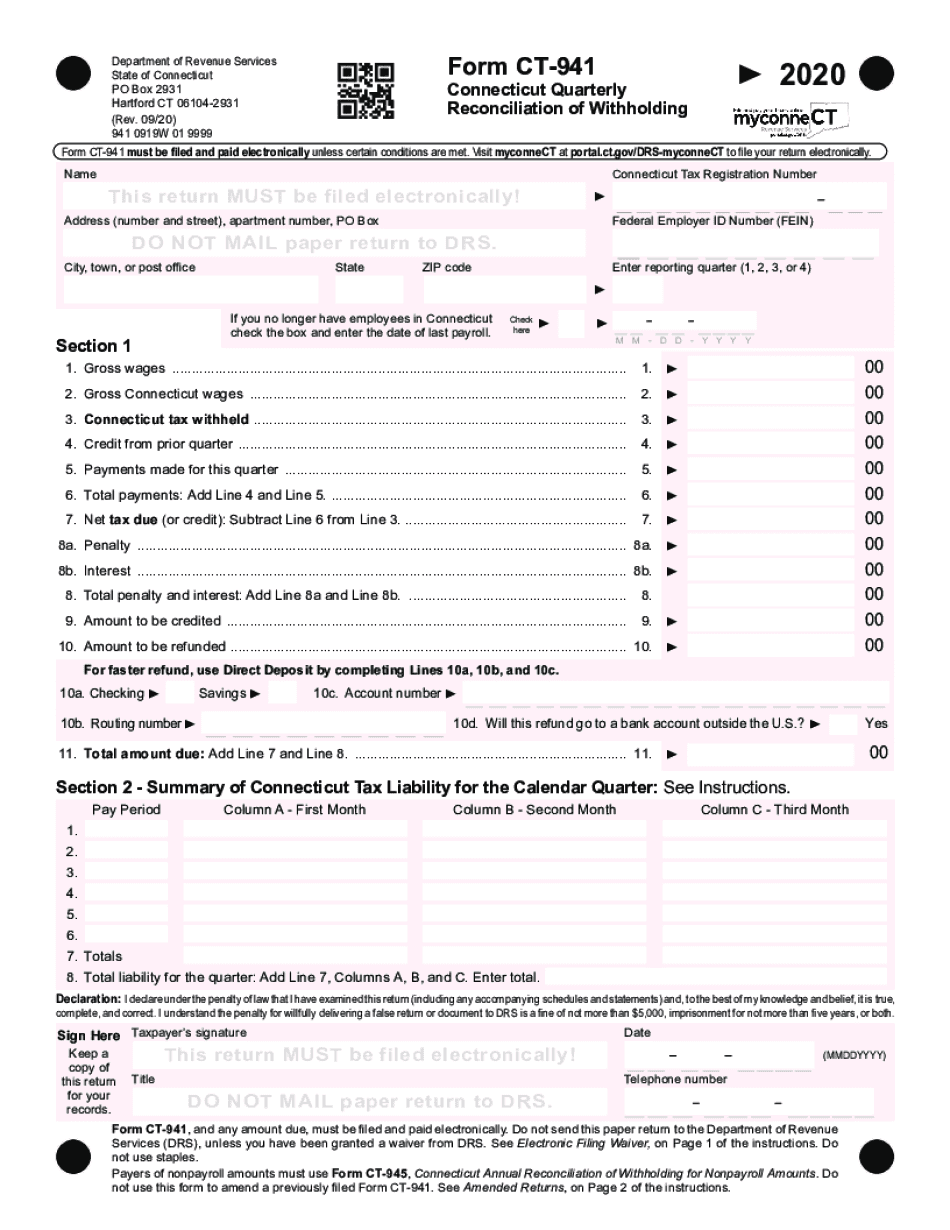

Ct 941 Instructions 20202024 Form Fill Out and Sign Printable PDF, The rate cuts take effect january 1, 2024. Those laws include the first tax year kicking off for the middle income tax reductions approved in june by the general assembly and gov.

Connecticut PassThrough Entity Tax 2023 2024, Measures that went into effect on new year’s day include a tax cut for many connecticut taxpayers, a change in the state’s minimum wage, and new rules pertaining to early voting. The changes were scheduled to go into effect on jan 1, 2024.

2024 Tax Assistance Information Trumbull, CT, (wtnh) — three significant tax relief measures will take effect in connecticut on jan. The governor said connecticut’s new earned income tax credit is increasing from 30.5% to 40% of the federal eitc and this will provide an additional $44.6 million in state tax credits to.

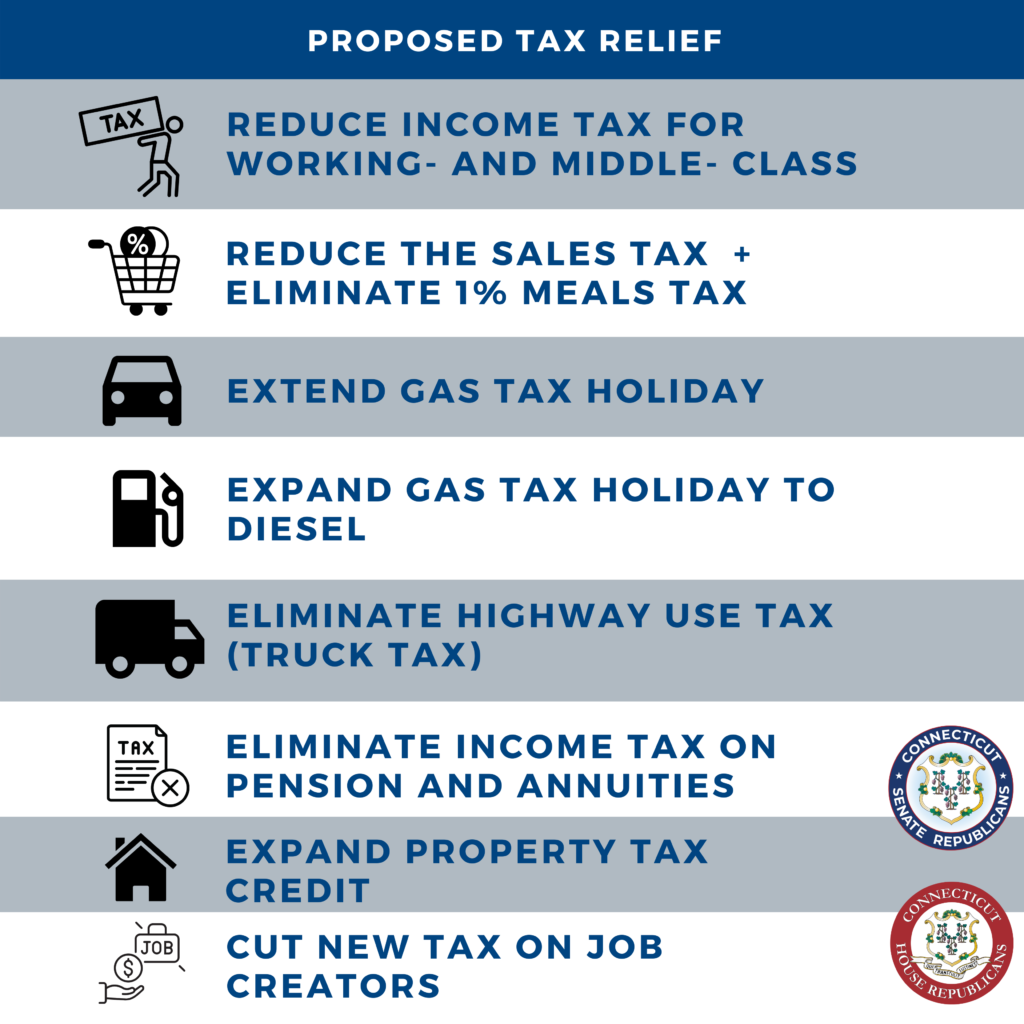

CT Republicans Offer 1.2 Billion Tax Relief Plan for Working and, 2024 will mark the beginning of tax cuts for the middle class. The changes were scheduled to go into effect on jan 1, 2024.

Ct Drs Op 236 Fill Online, Printable, Fillable, Blank pdfFiller, The state will also be increasing the minimum wage to $15.69 per hour and hiking the deposit on bottles and cans to. The changes were scheduled to go into effect on jan 1, 2024.

In Connecticut, the top 2 percent of residents pay most of the state’s, The tax tables below include the tax rates, thresholds and allowances included in the connecticut tax calculator 2024. As we ring in the new year, there are some laws that become effective on january 1 that were passed during the 2023 legislative session addressing key issue areas including early voting, health and mental health, and online privacy and data protection.

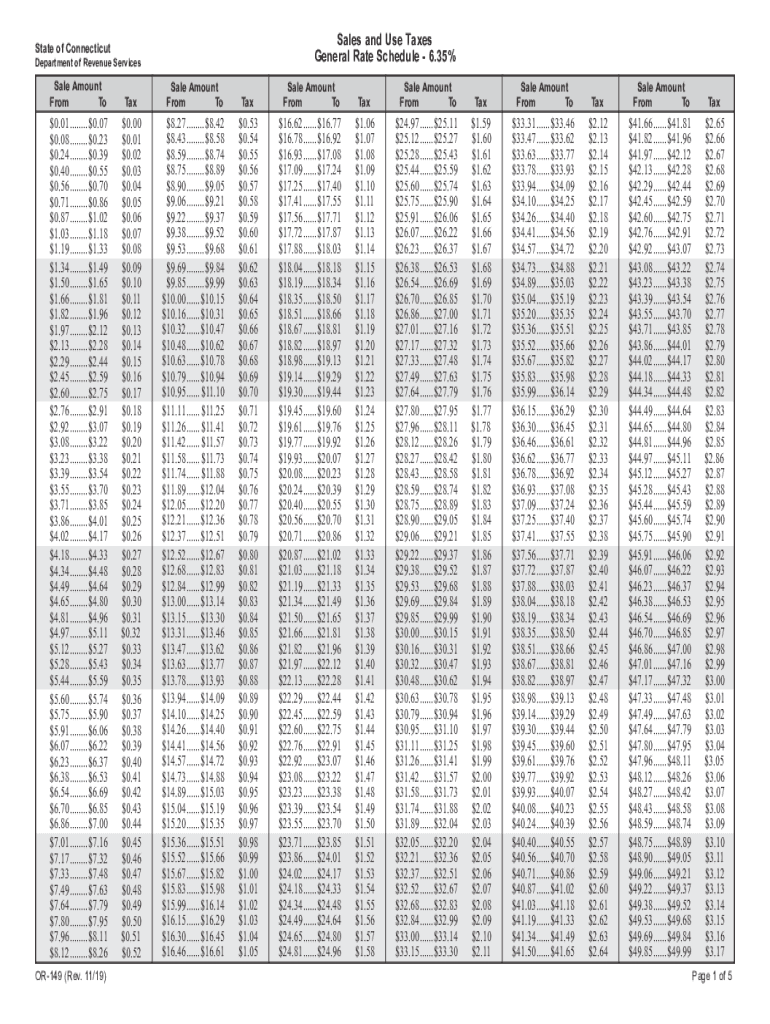

Ct Sales Tax Chart 20192024 Form Fill Out and Sign Printable PDF, 1 when dozens of laws passed in recent legislative sessions will be implemented. Currently, single (joint) filers pay a 3% state personal income tax on their first $10,000 ($20,000) of adjusted gross income and a 5% tax on income up to $50,000 ($100,000).

New Tax Laws in 2024 Explained (WATCH BEFORE One News Page VIDEO, New laws going into effect january 1, 2024. The tax tables below include the tax rates, thresholds and allowances included in the connecticut tax calculator 2024.

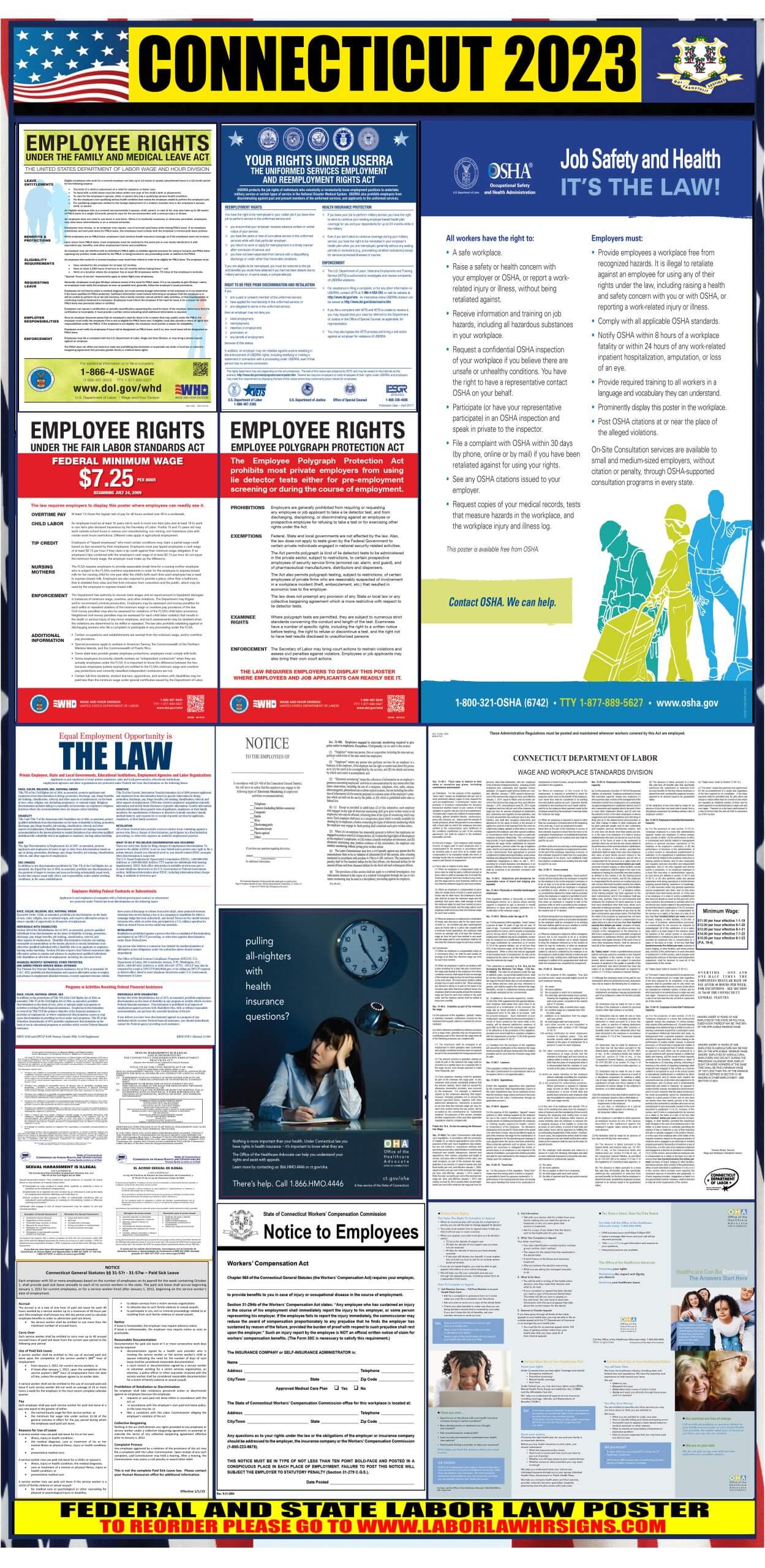

2023 Connecticut Labor Law Posters ⭐ State, Federal, OSHA, The changes were scheduled to go into effect on jan 1, 2024. The tax tables below include the tax rates, thresholds and allowances included in the connecticut tax calculator 2024.

Currently, single (joint) filers pay a 3% state personal income tax on their first $10,000 ($20,000) of adjusted gross income and a 5% tax on income up to $50,000 ($100,000).